January.15.2025

Lump-sum withdrawal payment may be made to foreign nationals who have coverage periods of six months or more under the Employees' Pension Insurance (EPI) system on the following conditions, in case they are unable to receive pension payments. The coverage period for which the payment is calculated will not constitute a coverage period for future benefits under the EPI system.

If you have paid contributions for Private School Mutual Aid Pension system for a year or more in total since October 2015, you are entitled to a lump-sum withdrawal of the Retirement Pension benefits as well.

Requirements

You are eligible for lump-sum withdrawal payment if you satisfy all the following seven requirements.

- You are not a Japanese citizen.

- You are not a resident in Japan.

- You have coverage periods of six months or more under the EPI system.

- You are not eligible for Old-age Employees' Pension period (see note below)

- You have never been entitled to receive a pension (including disability allowance).

- Two years have not passed since the date on which you last lost your insured status under the public pension system (If you had an address in Japan on the day you lost your insured status, two years have not passed since you no longer had an address in Japan after you lost your insured status).

Note:

For details on the pension eligibility period, click here.

Claim procedures

The place to apply for the Lump-sum Withdrawal Payment varies depending on your enrollment in the Japanese Pension System.

- If you have only the Promotion and Mutual Aid Corporation for Private Schools of Japan (PMAC) enrollment periods (Employees' Pension Insurance Category 4 Insured Person), the PMAC will decide and pay your Lump-sum Withdrawal Payment.

In this case, please apply to the PMAC. - If you have National Pension System enrollment periods and/or Employees' Pension Insurance enrollment periods within multiple implementing organizations (Japan Pension Service, National Public Officers Mutual Aid Association), the Lump-sum Withdrawal Payment will be decided and paid by the implementing organization in charge.

In this case, please apply to the implementing organization in charge.

Organization in charge

- If your National Pension Contribution-paid Period (Note) is less than six months = you are not eligible for the National Pension Lump-sum Withdrawal Payment ⇒ The organization in charge will be the Employees' Pension Insurance implementing organization where you were last enrolled.

- If your National Pension Contribution-paid Period (Note) is six months or more = you are eligible for the National Pension Lump-sum Withdrawal Payment ⇒ The organization in charge will be the Japan Pension Service, regardless of the Employees' Pension Insurance enrollment periods.

Note:

The total number of months of the National Pension Category 1 Insured Person contribution-paid period, plus 3/4 of the number of months of the period with exemption of 1/4 of the premium payment, plus 1/2 of the number of months of the period with exemption of 1/2 of the premium payment, plus 1/4 of the number of months of the period with exemption of 3/4 of the premium payment is six months or more. (The requirement to receive the Lump-sum Withdrawal Payment from the National Pension is that your total enrollment period is six months or more).

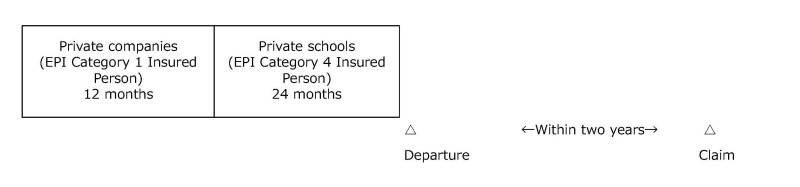

Example 1

If you have been enrolled as a Category 1 Insured Person in the Employees' Pension Insurance (Private Company) for 12 months and as a Category 4 Insured Person in the Employees' Pension Insurance (PMAC) for 24 months and then left Japan:

In this case, the PMAC will be the implementing organization, so please proceed with your claim to the PMAC.

If you have been enrolled in the PMAC system for one year or more since October 2015, you can also claim a Lump-sum Withdrawal Payment for Retirement Pension Benefits.

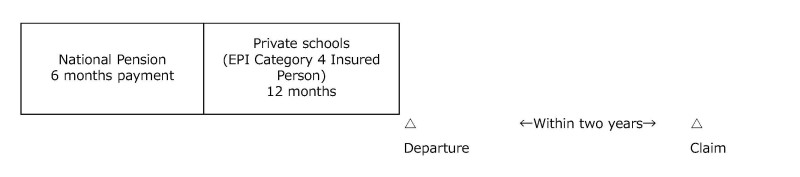

Example 2

If you have been enrolled in the National Pension for six months and as a Category 4 Insured Person in the Employees’ Pension Insurance (PMAC) for 12 months and then left Japan:

In this case, the Japan Pension Service will be the implementing agency, so please proceed with your claim to the Japan Pension Service.

If you wish to claim the Retirement Pension Benefits Lump-sum Withdrawal Payment, please make a separate claim to the PMAC.

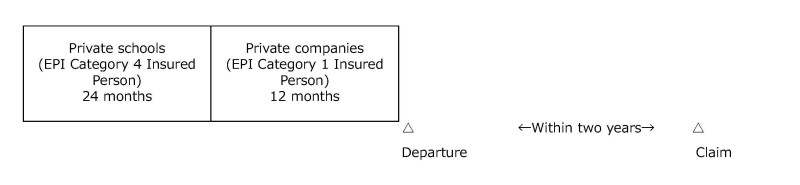

Example 3

If you have been enrolled as a Category 4 Insured Person in the Employees' Pension Insurance (PMAC) for 24 months and as a Category 1 Insured Person in the Employees' Pension Insurance (Private Company) for 12 months and then left Japan:

In this case, the Japan Pension Service will be the implementing agency, so please proceed with your claim to the Japan Pension Service.

If you wish to claim the Retirement Pension Benefits Lump-sum Withdrawal Payment, please make a separate claim to the PMAC.

Amount of Lump-sum Withdrawal Payment

Your lump-sum withdrawal payments are calculated as follows based on the length of coverage. The amounts payable to you are subject to tax withholding of 20.42%.

Formula

Payment amount (insurance benefits) = Average standard remuneration (Note 1) × Payment rate (Note 2)

A different formula shall be applied if the coverage period is before March 2005.

Note 1:

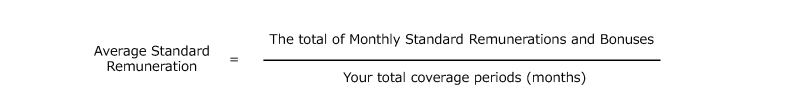

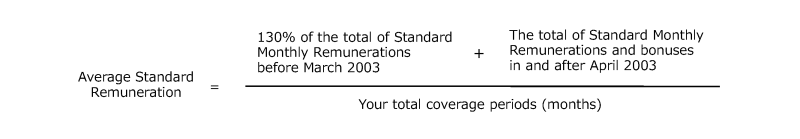

Average Standard Remuneration (ASR)

When the coverage period is entirely in and after April 2003,

When the coverage period is entirely or partly before March 2003,

Note 2:

Payment rate

Payment rate = (Premium rate (Note 3)×1/2)×number of coverage months (Note 4)

Note 3:

Premium rate

If your last covered month is between January and August, the premium rate as of October of the year before the previous year is applied.

If your last covered month is between September and December, the premium rate as of October of the year of the previous year is applied.

Note 4:

Number of coverage months

The following table shows the months to be used for the payment calculation based on the total coverage months (see Item (Note 5) below).

|

Your total coverage period |

The number of months used |

|---|---|

|

6 months or more and less than 12 months |

6 |

|

12 months or more and less than 18 months |

12 |

|

18 months or more and less than 24 months |

18 |

|

24 months or more and less than 30 months |

24 |

|

30 months or more and less than 36 months |

30 |

|

36 months or more and less than 42 months |

36 |

|

42 months or more and less than 48 months |

42 |

|

48 months or more and less than 54 months |

48 |

|

54 months or more and less than 60 months |

54 |

|

60 months or more |

60 |

Note 5:

If you only have the Employees' Pension insured periods earned before March 2021, the upper limit of the number of months used for the calculation is 36 months.

Note 6:

Total coverage months

If you lost residency in Japan and membership of the National Pension on and after October 1, 2015, when the consolidation of employee pension systems took place, the whole insured months of Employees' Pension shall be regarded as coverage period.

Remarks

- If you have received lump-sum withdrawal payment, the period for which the payment is made is not regarded as coverage period for future benefits under the EPI system.

- You may be qualified for the totalization benefits if you have qualifying coverage periods under pension systems of countries with which Japan has totalization agreements subject to certain qualification conditions. Once you have received lump-sum withdrawal payments, you may no longer include for future benefits the period for which the payments were made and its preceding period.

For more details on the social security agreement, click here. - The amount of your lump-sum withdrawal payments will be calculated depending on your coverage periods up to 60 months. Note that even if your coverage periods are 61 months or longer, your payments will still be calculated up to 60 months and you may no longer include for future benefits the period for which the payments were made and its preceding period.

Note:

If you only have the Employees' Pension insured periods earned before March 2021, the upper limit of the number of months used for the calculation is 36 months. - A new law enacted in August 2017 shortened Pension-benefit Qualified Period from 25 years to 10 years. Accordingly, you may not claim the payment of lump-sum withdrawal in and after August 2017 if your coverage period exceeds 10 years.

Japanese Site

Japanese Site Site Map

Site Map