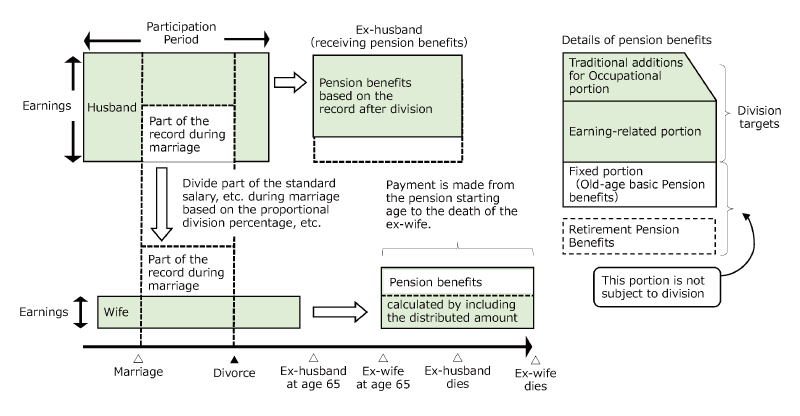

Employees’ Pension Division is a mechanism by which the total of the standardized monthly amount of remuneration and standardized amount of a bonus of the Employees’ Pension (hereinafter referred to as the “Standard Remuneration, etc.”) during the marriage period is divided up into two separate pension arrangements following a divorce or legal separation, which is consequently reflected in the pension benefits of both parties.

This mechanism is called the Pension Division System on Divorce and there are two types of pension share post-divorce: Agreed Division System and Category 3 Division System.

Note:

The system does not intend to directly split pension benefits but is used for splitting the Standard Remuneration, etc. based on which pension benefits are recalculated: The sum of the Standard Remuneration, etc., which is subject to division between the parties, is calculated through revaluation in accordance with relevant rules and regulations to appropriately reallocate it between the parties by granting some of it to the beneficiary who was entitled to less benefits. This rule applies to the entirety of the Standard Remuneration, etc. in the Employees’ Pension insured period (Categories 1 to 4) while they are married.

Agreed Division System

This is a system that allows the Standard Remuneration, etc. of the Employees’ Pension Insurance to be split between a divorcing couple upon request by either or both parties. The system is applicable to a divorce or legal separation that took place on or after April 1, 2007 and must satisfy the following conditions.

- Their marriage period includes in whole or part the Employees’ Pension insured period.

- A splitting ratio (Note) has been determined based on the agreement between the parties or under court order.

- A benefits claim must be made within the statutory period (in principle, within two years of the date following the date of divorce).

Note

The splitting ratio represents the amount of benefits the beneficiary is entitled to out of the total of both parties’ Standard Remuneration, etc. after it is divided. The ratio, which is up to 50%, is determined upon agreement between the parties. If they fail to agree on the ratio, either one of them may file a claim at a family court, which will determine the ratio through court procedures.

Upon request by either or both parties, PMAC will provide information necessary for reaching an agreement on the ratio (Request for the provision of information for the benefits division).

Illustration of Agreed Division System (Example: Providing part of the ex-husband’s pension benefits to the ex-wife)

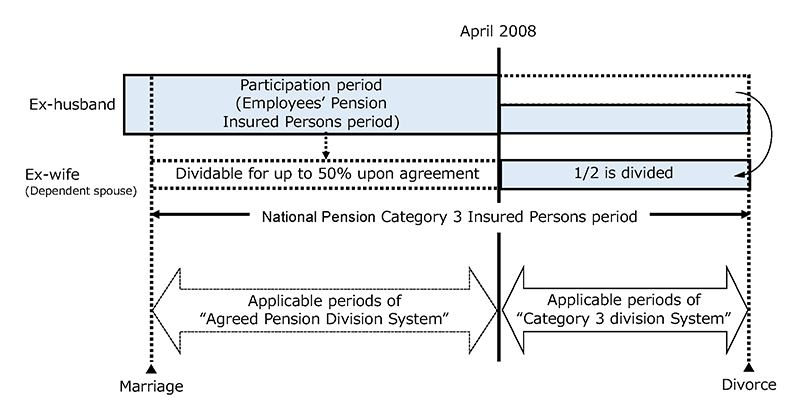

Category 3 Division System

This system is applicable to a divorce or legal separation that took place on or after May 1, 2008 and must satisfy the following conditions. Under the system, upon request by a National Pension Category 3 insured person (dependent spouse), the Standard Remuneration, etc. of their partner’s Employees’ Pension Insurance from April 2008 onward can be halved between the two.

- Their marriage period includes in whole or part the Employees’ Pension insured period.

- A benefits claim must be made within the statutory period (in principle, within two years of the date following the date of divorce).

There is no need for the parties to agree to filing a claim.

Please note, however, that, if the party subject to division of their pension (the party whose pension benefits are subject to reduction) is a recipient of the Disability Employees’ (Mutual Aid) Pension and if the period of pension division overlaps the pension calculation duration, the Category 3 Division System will not apply during the overlapping period.

Illustration of Category 3 Division System (Example: Providing part of the ex-husband’s pension benefits to the ex-wife)

Comparison between Agreed Division System and Category 3 Division System

|

Agreed Division System |

Category 3 Division System |

|

|---|---|---|

|

System effective in |

April 1, 2007 |

April 1, 2008 |

|

Applicable periods |

"Marriage period" |

"Specific periods" |

|

Division percentage |

Based on the "proportional percentage" agreed between both parties or determined by court procedures. |

Defined as 50%. |

|

Request procedures |

A request can be made by either party. A document that shows an agreement between both parties or court decision is required. |

A request must be made by a dependent spouse. An agreement between both parties is not required. |

Division Claim Deadline

Claim must be filed within two years of the date following the date of either of the actions 1 to 3 below.

- Divorce

- Annulment/cancellation of marriage

- When the claimer’s partner, who has been in de facto marriage with the claimer, is no longer qualified as being a National Pension as Category 3 insured person and their relationship is considered to be terminated

Note:

1. If a party filed for judicial proceedings or mediation on the ratio of pension division within two years of divorce, their claim for pension division is valid until six months after the date following the date when a trial decision or settlement on the rate was rendered.

2. A party is entitled to claim for pension division until one month after the day when the other party deceased.

Points to Note Regarding Pension Division Claim

- Once a claim has been filed for pension division under the Agreed Division System, it will automatically be processed under the Category 3 Division system as well.

- A claim for pension division is applicable at one time for all the contribution periods of all employee pension schemes, including the Employees’ Pension Insurance (for private sector employees) and pension schemes for mutual aid associations (for private school teachers and employees, and national and local government officials). In other words, a pension division claim submitted to a scheme will be dealt with under the rest of the pension schemes concerned at the same time.

- Even if a person whose pension has been subject to pension division (or whose pension benefits have been reduced due to pension division) started draw pension benefits, it does not mean that the person’s spouse can receive the pension share together now.

Pension Benefits after Pension Division

- The receiving party or the beneficiary of a pension share is entitled to receive it upon satisfying the pension entitlement requirements, including for the pension age and pension qualifying period (the period when the beneficiary has received the pension share will not be counted as the pension qualifying period).

- If the providing party or the beneficiary’s spouse (the person whose pension has been subject to pension division) is already a pensioner, the amount of their pension will be revised (reduced) from the month following the month when the beneficiary’s pension share claim was officially accepted.

- Even after the decease of the providing party, the amount of the receiving party’s pension share will remain unchanged.

- This pension sharing involves the remuneration-related portion of the Employees’ Pension and transitional additional benefits for the occupational portion (the Mutual Aid Pension) only; the Basic Pension amount or Retirement Pension benefits (New Tier 3 Pension) is not subject to division.

Japanese Site

Japanese Site Site Map

Site Map