January.15.2025

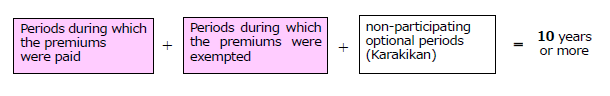

The minimum required participation period to receive Old-age Basic Pension or Old-age Employees’ Pension (Pension-benefit Eligibility Period) is 10 years combining the periods during which the premiums were paid (premium-paid periods), periods during which the premiums were exempted (premium-exempted periods) and non-participating optional periods (Karakikan).

Note:

The required period for pension benefit eligibility will be shortened due to legal changes effective from August 2017.

Periods during which the premiums were paid (= premium-paid periods)

"Premium-paid periods" are as follows:

- Periods during which the National Pension premiums were paid.

Periods of being a Category 1 or 3 Insured Person in the National Pension from April 1961 to March 1986 and after April 1986. - Periods of being an insured person in the Employees’ Pension Insurance

For PMAC members, periods of being a Category 4 Employees’ Pension Insured Person of the Employees’ Pension Insurance (refer to structure of public pension system).

Periods during which the premiums were exempted (= premium-exempted periods)

Periods during which the premiums for the National Pension were exempted.

Depending on the income level, the exemption of National Pension premiums is determined to be a full exemption, 3/4 exemption, half exemption or 1/4 exemption, which determines the reduction amount of the Old-age Basic Pension.

The amount of the Old-age Basic Pension during the pension payment period will be reduced proportionate to the amount of exemption.

Non-participating optional periods (Karakikan)

The following periods are not reflected in the calculation of pension benefits but included in the Pension-benefit Eligibility Period:

- Periods between April 1961 and March 1986 in which dependent spouses of salaried workers, disability pension beneficiaries or their spouses, survivor pension beneficiaries, or beneficiaries of other pension benefits did not participate in the National Pension when they were between the ages of 20 and 59 even though they were entitled to.

- Periods up to March 1991 during which a student who was then age 20 or older and under age 60 but did not voluntarily participate in the National Pension.

- Period on and after April 1961 during which a Japanese national who was then age between 20 and 59 lived overseas (from April 1986, the period that the person did not voluntarily participate).

- Periods from April 1961 to December 31, 1981 during which a person who was then age between 20 and 59 and had acquired Japanese nationality or permanent residency before age 65 lived in Japan.

- For persons who are eligible to Item 4, periods from April 1961 to the day before Japanese nationality acquisition or the day of permanent residency acquisition during which the person who was then age between 20 and 59 lived overseas.

- Periods on and after April 1961 during which a person who was then age between 20 and 59 voluntarily participated in the National Pension but did not pay the premiums.

Reduction of Pension-benefit Qualified Period (implemented on August 1, 2017)

Following the law amendment enforced on August 1, 2017, the requirements of Pension-benefit Qualified Period has been reduced from 25 years (Note) to 10 years.

|

Category |

July 2017 or earlier |

August 2017 and after |

|---|---|---|

|

The sum of premium-paid periods, premium-exempted periods, and non-participating optional periods is equal to or exceeds 25 years (Note) |

Meets the required Pension-benefit Eligibility Period |

Meets the required Pension-benefit Eligibility Period |

|

The sum of premium-paid periods, premium-exempted periods, and non-participating optional periods is equal to or exceeds 10 years but is under 25 years (Note) |

Does not meet the required Pension-benefit Eligibility Period |

Meets the required Pension-benefit Eligibility Period |

|

The sum of premium-paid periods, premium-exempted periods, and non-participating optional periods is under 10 years |

Does not meet the required Pension-benefit Eligibility Period |

Does not meet the required Pension-benefit Eligibility Period |

Note:

Even though the minimum Pension-benefit Eligibility Period is 25 years in principle, there is an exception to reduce the length between 15 and 24 years depending on the date of birth.

Japanese Site

Japanese Site Site Map

Site Map