January.15.2025

Old-age Basic Pension benefits are paid from age 65 to those who satisfy the Pension-benefit Qualified Period and have periods of being an insured person of the National Pension.

Pension amount

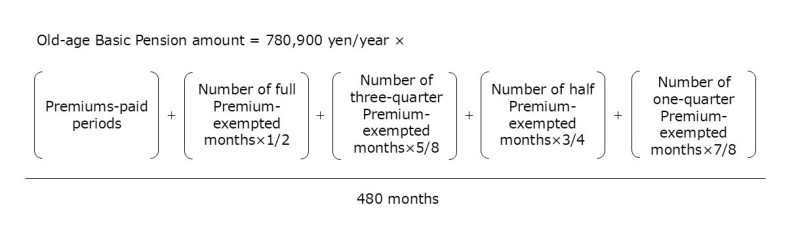

The annual pension amount of the Old-age Basic Pension is 780,900 yen if the premiums have been paid for 40 years from age 20 to age 60. For persons with periods exempted from paying the premium, periods when the premiums were not paid and/or periods when the person did not participate in the pension, the amount will be reduced.

Caluculation formulra

Note:

The Old-age Basic Pension Amount is revised annually.

Where to submit Old-age Basic Pension Payment application

Determination and payment of Old-age Basic Pension are carried out by the Japan Pension Service. However, where to submit payment application varies as shown below depending on the pension participation history of a person with eligibility to receive benefits.

|

Pension system participation history |

Where to submit |

|

|---|---|---|

|

1 |

Persons participating in PMAC system only |

PMAC |

|

2 |

Persons with a participation history in PMAC system and other pension plans |

Japan Pension Service branch office nearby |

|

3 |

Persons who are eligible for Special payment of Old-age Employees' Pension by the Japan Pension Service |

Japan Pension Service head office |

Transfer Addition for Dependent Spouse

If you were born on or before April 1, 1966 and is entitled to an additional pension amount that is applicable to your spouse’s Old-age Employees’ Pension (the Old-age Mutual Aid Pension) or Disability Employees’ Pension (the Disability Mutual Aid Pension), an additional amount will be granted to your Old-age Basic Pension, which is determined based on the year, month, and date of your birth. It is called the Transfer Addition.

The additional amount provided based on the Old-age Employees’ Pension (or the Retirement Mutual Aid Pension or the Disability Employees’ Pension (or the Disability Mutual Aid Pension) will be granted to you until you reach 65.

Early Payment

The Old-age Basic Pension is payable at 65 in principle, but upon request, you may opt to commence the pension at an age between 60 and 64.

Please note that the pension will then be lower than the standard pension available at age 65. The reduction rate will remain the same for lifetime.

Rate of Reduction due to Early Payment

Persons born on or before April 1, 1962: 0.5% per month

Persons born on or after April 2, 1962: 0.4% per month

In addition, the Old age Employees’ Pension will be lowered together and the same reduction rate will apply for lifetime.

Delayed Payment

The Old-age Basic Pension is payable at 65 in principle, but you may opt to delay the commencement of the pension from 65 to 66 or beyond.

A delay in pension payment will increase the pension amount. The increase rate will remain the same for lifetime.

Rate of Reduction due to Delayed Payment

People born on or after April 2, 1962: 0.7% per month

Please note that you can delay the commencement of your Old-age Basic Pension and that of your Old-age Employees’ Pension respectively and independently.

Japanese Site

Japanese Site Site Map

Site Map