January.15.2025

The payment of Additional Pension amount is suspended if a person eligible to receive the Old-age Employees'(Retirement Mutual Aid) Pension or Disability Employees'(Mutual aid) pension, or a spouse subject to addition of Additional Pension amount meets any of the condition 1, 2, 3, or 4.

- When a spouse eligible for an Additional Pension is entitled to an Old-age Pension /Retirement Pension with a calculation period of 20 years or more (including cases with a calculation period of 20 years or more meeting the requirements for totalization of enrollment periods or cases with a calculation period of less than 20 years but under a special provision considered as 20 years)

- When a spouse eligible for the Additional Pension receives a Disability Pension

- When an Old-age Employees' Pension recipient aged 65 or older receives a Disability Basic Pension with an added Child's Additional Amount (the Child's Old-age Employees' Pension Additional Pension Amount payment will be suspended)

- Only if a Retirement Mutual Aid Pension recipient receives an Old-age /Retirement Pension with an added Additional Pension Amount paid by the Japan Pension Service or a National Public Officers Mutual Aid Association

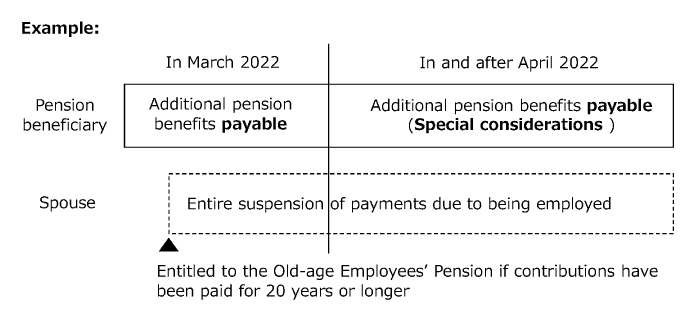

Special considerations under the revised law coming to effect in April 2022.

If, as of March 2022, a spouse eligible for additional pension benefits is receiving both the Old-age Employees’ Pension and the Disability Employees’ Pension together with the additional pension benefits and has been subject to total suspension of pension benefits payable due to age or retirement (except for pension suspension upon request), the spouse will continue to be paid the additional pension benefits.

Japanese Site

Japanese Site Site Map

Site Map