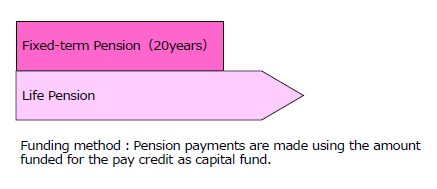

There are the two following types of Retirement Pension plans:

- Life Retirement Pension from which one receives benefits over a lifetime

- Fixed-term Retirement Pension from which one receives benefits for a fixed period of time

Requirements

Retirement Pension benefits are paid when all of the following requirements are met:

- A continuous participation period of 1 year or longer(Note 1)

- Age 65 or older(Note 2)

- Retired (including withdrawal at age 70)

Note 1:

“Continuous participation period of 1 year or longer” includes not only a participation period after the consolidation but also a participation period before the consolidation, which continues to October 1, 2015.

Note 2:

If the person wishes, upon request, you may opt to start early payment anytime between 60 and 64. You may also opt to delay payments by a maximum of 10 years (up until age 70 for those born April 1, 1952 or earlier) from the date of entitlement to the Old-age Employees’ Pension.

Payment pattern

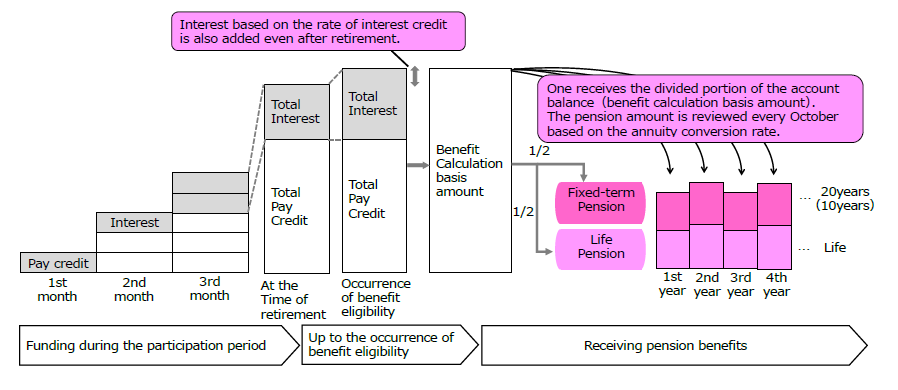

One half of the benefit calculation basis amount is provided as Life Pension and the other half is provided as Fixed-term Pension.

The payment period for Fixed-term Retirement Pension Benefits is 20 years in principle. However, the person can apply to select 10 years or receive as a Lump-sum Payment instead of pension benefits.(Note)

If the person is also eligible to receive Disability Pension Benefits (disabled while on duty), the person must choose either one of the pensions.

Note:

This only applies when it is within six months of becoming eligible to receive pension and when the claim is made simultaneously with the claim for retirement pension.

Payment of Retirement Pension

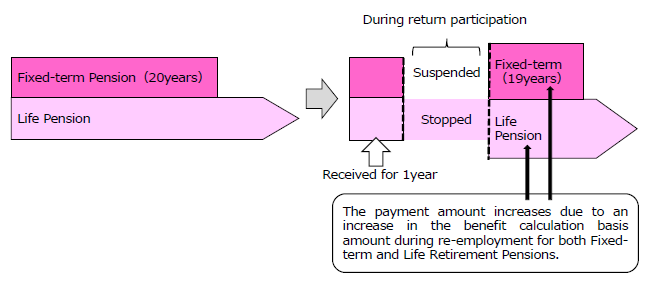

If a person with the eligibility to receive Retirement Pension returns to participation in the PMAC System, the payment of Life Retirement Pension is stopped and that of Fixed-term Retirement Pension is suspended.

If a member who is a pension-benefit qualified person retires again, the pension benefit amount is revised based on the total amount resulting from adding the total of the pay credit and its interest to the benefit calculation basis amount before return participation. The payment of Fixed-term Retirement Pension resumes and is provided for the remaining number of months resulting from deducing the number of months during which the person received the benefits before the return participation.

When a person with the eligbility to receive Retirement Pension returns to participation in the PMAC System

Making a Claim

PMAC will send a notice on payment request to the person that met the requirement to receive the pension or has retired for the second time.

We cannot send this to a person living outside of Japan. Contact PMAC when the person meets the requirements to receive the pension.

Scheme of Retirement Pension

The pension benefit is paid by a funding method in which pension payments are made using the amount funded for the pay credit as capital fund.

- Pay credit is calculated by multiplying the monthly standard salary and standard bonus by the Rate for Accumulate.

Note:

If premium payments from the school are behind over a long period of time, the rate for accumulation is reduced by half for the non-payment period in the calculation. The original rate is recovered and used in the calculation, in principle, when the non-paid premiums are paid. - Rate for accumulation are determined by considering the benefit standard level, etc. required for maintaining a stable livelihood in the future.

- Interest is calculated using the rate of interest credit linked to Government bond yields, etc.

- A benefit calculation basis amount is calculated by adding interest to the monthly Pay credit.

- An annual pension amount is revised based on the annuity conversion rate.

- Rate for Accumulate, rate of interest credit and annuity conversion rates are defined in the PMAC Regulations.

Benefit calculation basis amount

A benefit calculation basis amount (each member's account balance) at the time when eligibility to receive benefits comes into effect is calculated by adding the accumulated amount resulting from multiplying the monthly standard salary/standard bonus of each month over the participation period by the Rate for Accumulate of each month to the interest corresponding to each period.

The amount of Retirement Pension is calculated using this benefit calculation basis amount as follows:

- Life Retirement Pension = Benefit calculation basis amount × 1/2 ÷ Life annuity conversion rate (annually revised)

- Fixed-term Retirement Pension = Benefit calculation basis amount × 1/2 ÷ Fixed-term annuity conversion rate (annually revised)

Note:

The amount of Retirement Pension is revised since the “rate of interest credit” and “annuity conversion rate” are annually reviewed.

Annuity conversion rate

For Life Retirement Pension, it is called life annuity conversion rate, and for Fixed-term Retirement Pension, it is called fixed-term annuity conversion rate.

For Fixed-term Retirement Pension, when pension payments are given to a person by dividing the benefit calculation basis amount over 20 years, the base amount is divided by a rate (called "annuity conversion rate") that considers the interest income based on the rate of interest credit, etc. applied during the benefit reception period, instead of simply dividing it by 20. In this manner, a fixed-term annuity conversion rate is calculated based on the interest rate (rate of interest credit) for calculating the interest and the pension benefit reception period.

Life annuity conversion rate is calculated by taking the average life expectancy and the rate of interest credit into account.

Japanese Site

Japanese Site Site Map

Site Map