January.15.2025

When an insured person or previously insured person of Employees' Pension Insurance who meets either of the following requirements (1) - (4) dies, Survivors' Employees' Pension is given to the spouse, children, parents, grandchildren, or grandparents whose annual income is below 8,500,000 yen (or annual income after deduction below 6,555,000 yen) and whose livelihood was maintained by the person.

Children and grandchildren in this case should be those unmarried who have not passed the last day of the fiscal year containing his/her 18th birthday or those unmarried with a Grade 1 or 2 disability under age 20.

Husband, parents and grandparents in this case must be age 55 or older and payment is suspended until they reach age 60.

Note:

The definition of spouse includes a de facto spouse.

Requirements

(1) When an insured person of the Employees' Pension Insurance dies.

(2) When a person dies due to sickness or an injury for which the first visit was during the time the person was an insured person of Employees' Pension Insurance and the date of his/her death is within 5 years after the first visit.

(3) When a person who is eligible to receive Grade 1 or 2 the Disability Employees'(Mutual Aid) Pension dies.

(4) When a person who is eligible to receive the Old-age Employees'(Retirement Mutual Aid) Pension dies.

Note 1:

There are insurance premiums payment requirements for (1) to (2).

The insurance premiums payment requirements are the same as that of Survivors' Basic Pension.

Note 2:

The amendment to the legislation enabling the reduction of the pension-eligibility period to 10 years does not apply to (4).

Survivor's priority order

1 Spouse (wife or husband) and children, 2 Parents, 3 Grandchildren, 4 Grandparents

Even when a person is categorized as a survivor who can receive Survivors' Employees' Pension, Only the person(s) with the highest priority can receive the benefits.

Even when a person with a higher priority loses the eligibility to receive Survivors' Employees' Pension, the subsequent priority persons do not become eligible to receive the benefits. (One cannot succeed to the right.)

When the spouse and children have the same priority, Survivors' Employees' Pension is suspended for the children while the spouse is eligible to receive Survivors' Employees' Pension.

Short-term and long-term requirements

For Survivors' Employees' Pension, when one of the requirements (1) - (3) to receive the pension is met, the pension is called Survivors' Employees' Pension with the short-term requirement, and when the requirement 4 is met, it is called Survivors Employees' Pension with the long- term requirement. They are handled differently for pension benefit calculation, payment request destination, benefit-paying institution, etc.

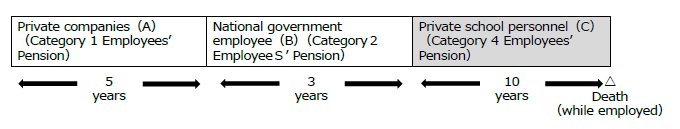

<Example 1>

Survivors' Employees' Pension with the short-term requirement

The implementing institution (final) at the time of a person's death is the responsible agency for the person. In this case, PMAC compiles A + B + C periods to determine and pays the pension benefits.

If A + B + C is less than 300 months, then 300 months is used to determine the amount of the Survivors' Employees' Pension with the short-term requirement.

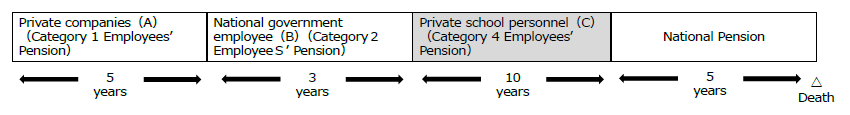

<Example 2>

Survivors' Employees' Pension with the long-term requirement

As with Old-age Employees' Pension, each implementing institution calculates, determines and pays the Survivors' Employees' Pension benefits.

The benefits for Period A (Category 1 Employees' Pension) is determined and paid by the Japan Pension Service.

The benefits for Period B (Category 2 Employees' Pension) is determined and paid by the Federation of National Public Service Personnel Mutual Aid Associations.

The benefits for Period C (Category 4 Employees' Pension) is determined and paid by PMAC.

Making a payment request to one of these agencies automatically completes a request to all of these Survivors' Employees' Pensions (One-Stop Service).

Pension amount

Amount of Survivors' Employees' Pension is a total of an amount as a result of multiplying the amount of earning-related portion used for Old-age Employees' Pension by 3/4 and Addition for Widows in principle. However, it varies depending on whether it is based on the short-term or long-term requirement and the ages of the survivors.

Addition for Widows

1. For wives between the ages of 40 and 64 (Addition for Middle and Advanced-age Widows)

For wives who cannot receive Survivors' Basic Pension but only receive Survivors' Employees' Pension and for wives whose eligibility for Survivors' Basic Pension ceases because their children have reached the age of 18, an addition of 585,700 yen/year is provided between age 40 (if the eligibility for Survivors' Basic Pension ceased at age 40 or later) and 59 inclusive as an Addition for Middle and Advanced-age Widows. However, this addition is provided to Survivors' Employees' Pension with the short-term requirements or with the long-term requirements. (only when a person who has 20 years or more of Employees' Pension Insurance Insured Persons period dies.) For the long- term requirement, this addition is added to the Survivors' Employees' Pension of an agency in which the person has the longest period of participation.

2. For wives aged 65 or older (Transitional Addition for Widows)

For wives who were born on April 1, 1956 or earlier, their participation period in the National Pension is generally short and as a result the amount of Old-age Basic Pension are low, thus a Transitional Addition for Widows (585,700 yen - 19,547 yen/year) according to the birth date of the wife is added.

Note:

The Widow's Additional Amount is revised annually.

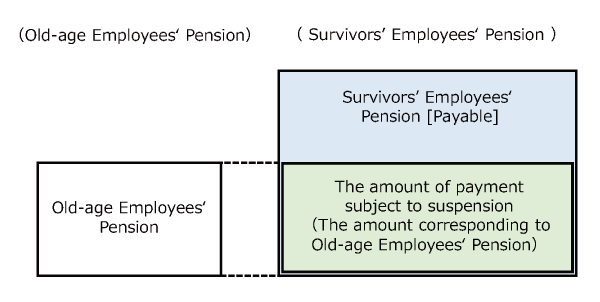

Survivors' Employees' Pension Payable at 65 (Prioritization of the Old-age Benefits)

If you are aged 65 or over and are eligible for the Survivors' Employees' Pension and Old-age Employees' Pension, you will be paid the Old-age Employees' Pension in priority to the Survivors' Employees' Pension. If the amount of the Survivors' Employees' Pension is greater than that of the Old-age Employees' Pension, the difference is additionally paid as the Survivors' Employees' Pension. This approach is called the Prioritization of the Old-age Employees' Pension.

If the amount of the Old-age Employees' Pension is greater, the Survivors' Employees' Pension will not be paid.

Japanese Site

Japanese Site Site Map

Site Map