Transitional additions for occupational portion (Retirement Mutual Aid Pension), is determined and given by PMAC, when the person has one or more consecutive year(s) of coverage in Private School Mutual Aid Program in or before September 2015 (Note) and meets all of the following requirements from 1 to 3.

Note:

The one or more consecutive year period can extend beyond October 1, 2015.

However, it is calculated only for the period up to and including September 2015 before the consolidation.

- Meets the required Pension-benefit Qualified Period

- Has one or more consecutive year(s) of coverage in Category 4 Employees’ Pension (Private School Employees’ Pension).

- Has reached the age based on corresponding rage of birth date.

Example

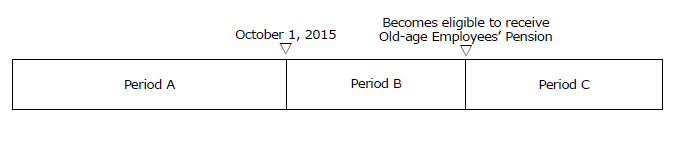

A person who was employed by a private school before the consolidation (in or before October 2015) becomes eligible to receive Old-age Employees' Pension after the consolidation (in or after October 2015).

The period to be calculated for Transitional additions for occupational pension (Retirement Mutual Aid Pension) is <Period A>.

Reference

2nd tier

The period to be calculated for Old-age Employees' Pension is <Period A + Period B>.

Note:

When the person reaches age 65 or becomes retired, Period C is also added to the calculated period.

New tier 3rd portion

The period to be calculated for Retirement Pension is <Period B + C>

Japanese Site

Japanese Site Site Map

Site Map