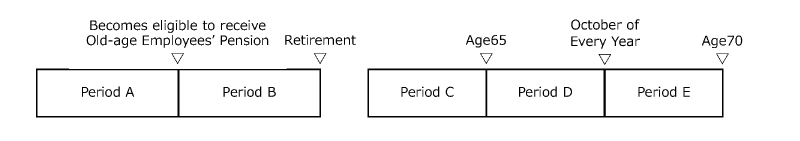

If you are entitled to the Old-age Pension benefit when you are in service (i.e. you are a Category 4 Employees’ Pension insured person), there are some milestones that determine the base period for calculating your pensions as follows.

At Retirement

Base period for pension calculation = Period A + Period B

Your pension amount after retirement will be recalculated based on the Disqualification Report submitted by a school corporation. You are not required to be involved in the procedure.

Note:

If you retire from a mutual aid scheme and then rejoin it within a month of the day following the date of your disqualification due to retirement, your pension calculation period will remain unchanged.

At Age 65

Base period for pension calculation = Period A + Period B + Period C

At age 65, you will lose your entitlement to the Specially Provided Old-age Employees’ Pension, but you will be eligible for the regular Old-age Pension instead. Accordingly, your pension amount will be recalculated based on the insured period up until 65. To proceed, please fill out and submit a form that PMAC will send to you.

In October of Every Year(at age 65 or older)

Base period for pension calculation = Period A + Period B + Period C + Period D

If you are entitled to the Old-age Employees’ Pension when you are in service at 65 or older and are an insured person as of September 1, your pension amount will be recalculated in October, the following month, based on your insured period up until September 1. The recalculation procedure, called the Regular Recalculation during the Term of Employment, will be performed every year. You are not required to be involved in the procedure.

At Age 70

Base period for pension calculation = Period A + Period B + Period C +Period D + Period E

At age 70, you will be regarded as a retired person and lose the entitlement as an insured person under the Employees’ Pension Insurance even if you are in service. Accordingly, your pension amount will be recalculated based on the insured period until then. You are not required to be involved in the procedure.

Note:

If you are in service at 70 or older and the total of your pension payments and remuneration exceeds a given threshold, part of your pension payments will be suspended.

Japanese Site

Japanese Site Site Map

Site Map