January.15.2025

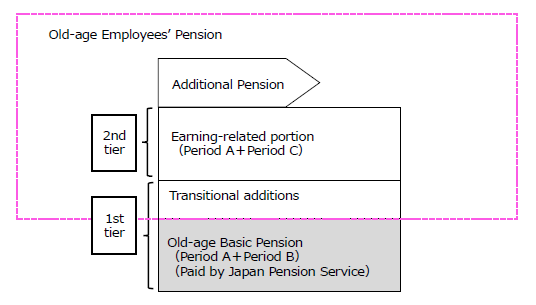

The Old-age Employees' Pension basically comprises Tier 2, namely the Remuneration-related Pension Benefit. The Transitionally Added Amount belongs Tier 1 of the regular Old-age Employees’ Pension commencing from age 65. In some cases, the Additional Amount is provided in addition to these pensions.

These pension amounts are calculated and determined using the data including the number of months in the pension contribution period (the insured period), the monthly standard remuneration, and the standard amount of a bonus.

Pension amounts are reviewed every year based on the rate of wage change and that of price changes and that of wage changes. In addition, the mechanism, called a macroeconomic slide formula, has been introduced to control increase in pension amounts by taking into account the rate of change in the population of the working generation and the growth in the average life span of pensioners.

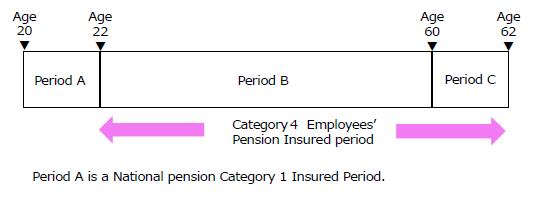

Example: An individual who was employed by a private school at age 22 and had since worked for the school until retiring at age 62

Structure of Old-age Employees’ Pension

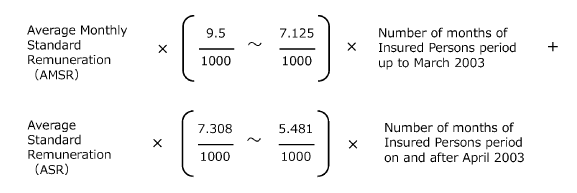

Remuneration-related Pension Benefit

Amount proportional to earnings and length of Period B + Period C

Note:

The coefficient is determined by the pensioner’s date of birth. For example, the coefficient for those born on or after April 2, 1946 is 7.125/1000 for the AMSR and 5.481/1000 for the ASR, respectively.

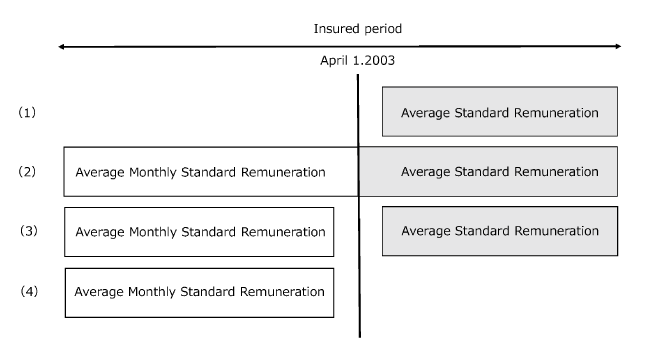

Average Standard Remuneration and Average Monthly Standard Remuneration

The Remuneration-related Pension Benefit is calculated based on the Average Standard Remuneration (ASR).

However, if the insured period commences before April 2013, the Remuneration-related Pension Benefit for the period up to March 2013 is calculated using the Average Monthly Standard Remuneration (AMSR).

- Average Standard Remuneration:

The sum after reevaluating the standard monthly remuneration and standard bonus for each month of the insured period in and after April 2003, divided by the number of applicable insured period in months. - Average Monthly Standard Remuneration:

In principle, the sum of re-evaluated Monthly Standard Remuneration for each month that the calculation of the insured period in and before March 2003 is based on, divided by the number of applicable insured period in months.

Note:

The average monthly standard remuneration of a person with a insured period before April 1, 1986 is calculated using a different formula.

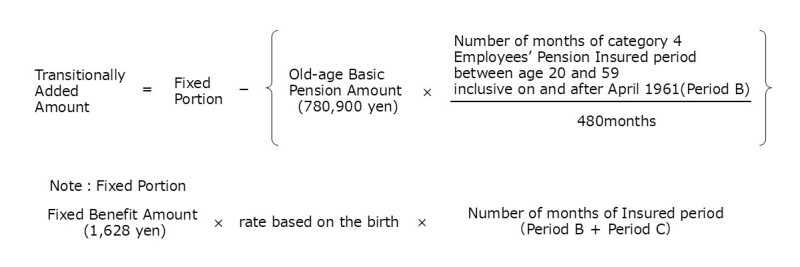

Transitionally Added Amount

Of the Employees' Pension Insurance (EPI) insured period, Tier 1 covering the period from age 20 to 59 is the period based on which the Old-age Basic Pension (the National Pension) is calculated. As such, the amount equivalent to the Old-age Basic Pension is deducted from Tier 1 (the fixed-amount portion) of the Old-age Employees’ Pension.

In the example, the amount equivalent to the Old-age Basic Pension for the Category 4 Employees’ Pension insured period (the amount of the Old-age Basic Pension × Period B / 480 months) is deducted from the fixed-amount portion (the amount calculated according to the length of Periods B and C).

Note, however, that because the Category 4 Employees’ Pension insured period before age 20 or after 59 (Period C) is not part of the period based on which the Old-age Basic Pension is calculated and for other reasons, the difference between the fixed-amount part and the amount equivalent to the Old-age Basic Pension benefits is provided to the pensioner as a Transitionally Added Amount.

Calculation formula

Note:

The Old-age Basic Pension Amount and Fixed Benefit Amount are revised annually.

Additional Amount

You will receive an Additional Amount, in principle, if you are entitled to receive the Old-age Employees' Pension and meet the following two criteria at 65.

- You have at least 20 years of insured period under the Old-age Employees' Pension system (the total of Category 1 to 4 Employees' Pension insured person periods)

- You support the livelihood (Note) of a family member of yours who is:

2-1. a spouse under 65 (including a de facto spouse);

2-2. a child before the first 31 March after the child become 18; or

2-3. a child under 20, diagnosed with Disability Grade 1 or 2 under the Employees' Pension Insurance Act.

The Additional Amount will be included in Old-age Employees' Pension managed by a pension operations organization where your insured period under the Employees' Pension Insurance system is longest.

Note:Definition of "full support"

If an annual earnings of a spouse or child who share living costs is less than 8,500,000 yen (or an annual income of 6,555,000 yen), they are qualified to be a dependent for full support.

In addition, even when the annual earnings exceed 8,500,000 yen, if it can be objectively confirmed that consistent earnings (income) will decrease due to mandatory retirement in the near future (within approximately 5 years), etc., dependent for full support may be approved.

|

Spouse |

224,700 yen/year |

|---|---|

|

1st/2nd child |

224,700 yen/year |

|

3rd and subsequent children |

74,900 yen/year |

For persons eligible to receive benefits who were born on April 2, 1934 or later, one of the following amounts is also added as a special addition.

|

Birth date of pension-benefit certified person |

Special addition |

|---|---|

|

April 2, 1934 - April 1, 1940 |

33,200 yen |

|

April 2, 1940 - April 1, 1941 |

66,300 yen |

|

April 2, 1941 - April 1, 1942 |

99,500 yen |

|

April 2, 1942 - April 1, 1943 |

132,600 yen |

|

April 2, 1943 - |

165,800 yen |

Note:

The Additional Pension Amount and Special Supplementary Pension Amount are revised annually.

Japanese Site

Japanese Site Site Map

Site Map