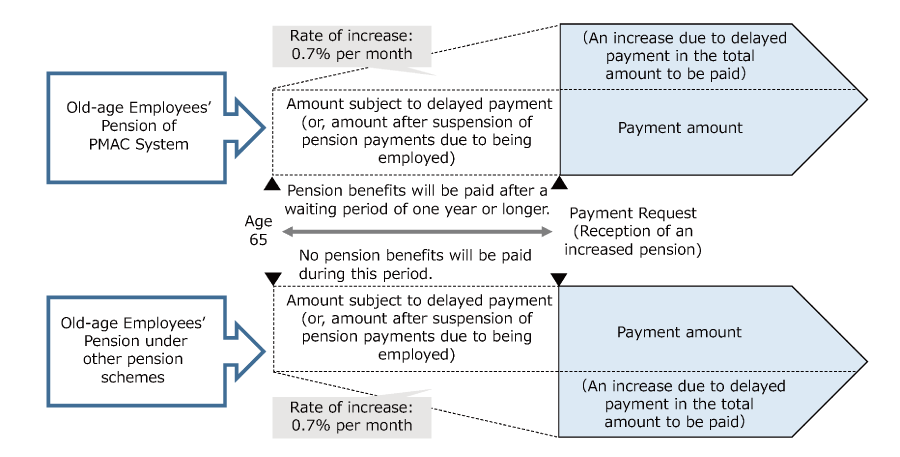

By delaying or deferring the payment of your pension benefits by at least a year, you will receive more amount per payment. The amount receivable varies depending on the number of delayed months.

If you are entitled to a pension under other old-age pension schemes (Note), you must delay the payment of the pension benefits as well; you may not delay only one of them. There is no need to delay your Old-age Basic Pension.

Note:

The Japan Pension Service, mutual aid pensions for government officials, etc.

Rate of Increase due to Delayed Payment

0.7% per month

Delayed Period

- Those entitled to the regular Old-age Employees' Pension on or before March 31, 2017: Up to 5 years

- Those entitled to the regular Old-age Employees' Pension on and after April 1, 2017: Up to 10 years

Illustration of Delayed Payment

Amount of Increase due to Delayed Payment

If you opt to delay the payment of your Old-age Employees’ Pension benefits, your pension payments will increase by an additional amount.

This additional amount is determined by the amount of the Old-age Employees’ Pension benefits calculated based on the period until the month preceding the month when you became entitled to the Old-age Employees’ Pension, during which you were a category IV insured person under the Employees’ Pension Insurance system, as well as the amount of the pension benefits you would have received if you did not opt for delayed payment (Note), the delayed period, and other data.

Note:

1. If you are in service, the additional increase is determined based on the amount paid during the term of employment (the amount after suspension).

2. This scheme is not applicable to the Additional Pension.

Those who cannot delay their payment

If, in addition to the Disability Basic Pension, you are eligible to receive disability benefits or survivors’ benefits (hereinafter referred to collectively as the “Disability Benefits, etc.”), you may not delay the payment of the Old-age Employees' Pension Benefits (Note).

Note:

You may not delay the payment of the Old-age Employees' Pension Benefits if you become eligible to receive the Disability Benefits, etc. within one year of acquiring the Old-age Employees' Pension rights.

If you become entitled to your Disability Benefits, etc. in more than one year after acquiring the Old-age Employees' Pension rights, you may no longer delay the payment of the Old-age Employees’ Pension.

Japanese Site

Japanese Site Site Map

Site Map