March.2.2026

If a person has a period of membership for a continuous one year and one day or longer (excluding a Voluntarily Continued Insurance Member period in the past), the person can be a Voluntarily Continued Insurance Member who can use the Short-Term Benefits program and Welfare Services (excluding loan/savings services) up to 2 years. However, when a person participates in the Medical System for the Old Elderly while being a Voluntarily Continued Insurance Member, the membership is valid until one day before the participation.

Note:

If a Voluntarily Continued Insurance Member acquires membership eligibility due to reemployment at a school and then retires from it in turn losing the eligibility, the person cannot be a Voluntarily Continued Insurance Member unless the person has a period of membership for one year and one day or longer at the new job.

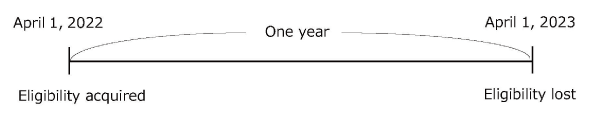

<Case example> Employed on April 1,2022 and retires on March 31,2023

Note:

This person cannot be a Voluntarily Continued Insurance Member because the membership period is only one year.

Application should be made within 20 days after retirement

- An application must be made within 20 days after retirement in order to become a Voluntarily Continued Insurance Member.

- Voluntarily Continued Insurance Member must make a benefit payment request, application for dependency approval, premium payment, etc. directly to PMAC by themselves.

The premiums for the Voluntarily Continued Insurance Plan

- For the premiums, Voluntarily Continued Insurance Member need to pay the premiums for Short-Term Benefits (including welfare benefits and Nursing-Care benefits) in its entirety. The premium payment methods are, monthly payment (automatic bank transfer is available), half yearly payment (from April to September and from October to March of next year), and yearly payment (from April to March next year). As a principle the method chosen when becoming a Voluntarily Continued Insurance Member will be applied for the next two years.

- Be sure to pay the premium before the payment due date using the payment slip.

- Persons using automatic bank transfer (monthly payment only) will also need to use the payment slips to pay the premiums before the automatic bank transfer starts or when the transfer was not implemented correctly (the transfer takes place on the 28th each month).

- Be aware that if the premium is not paid by the payment due date, you will lose either your qualification or your acquisition of qualification.

- If a Voluntarily Continued Insurance Member wishes to withdraw from the membership before reaching the full term of 2 years, a “Application form for withdrawal Voluntarily Continued Insurance Plan” must be submitted. The premiums already paid are returned for the period after eligibility loss.

- The premiums for the Voluntarily Continued Insurance Plan are subject to a social insurance deduction. (A “certificate verifying premium payment” is delivered at the end of October or at the end of January every year.)

Note:

Point to note regarding the payment of premiums for the Voluntary Continued Insurance Plan

Effective March 2022, premiums must be paid using Japan Post’s payment slip. The slip is not usable at any financial institutions other than Japan Post Bank.

Japanese Site

Japanese Site Site Map

Site Map