Determining and Revising the Monthly Standard Salary

- The Monthly Standard Salary is used to define the Monthly Standard Salary table for scaling members’ monthly earnings. They are used as the calculation basis for the premiums (Short-Term/ Pension Benefits and Nursing-Care) and various benefits.

- A member’s Monthly Standard Salary includes the allowances paid for dependents, commutation, after-hours work (overtime), etc. However, bonuses are not considered if the number of bonuses paid in a year is 3 or less.

- Although a member’s Monthly Standard Salary is determined at the time when the member acquires eligibility, once becoming a member, it is revised yearly on the basis of the member’s average income for the months of April, May, and June in order to ensure it correctly reflects the actual income. The revised Monthly Standard Salary is used as the basis for calculating the premiums and benefit payment from September to August of the following year.

If there are significant changes in the member’s income during this period (increase or decrease by 2 scales or more), the Monthly Standard Salary is revised after 3 months of the change (effective from the 4th month). - Other than “revisions as needed” a member can request to revise the Monthly Standard Salary when; a member raising a child under age 3 has their salary decreased by more than 1 scale after a childcare leave or a maternity leave (revised when the maternity or childcare leave ends) or when; a member over age 60 who has retired and is then rehired without a single blank day in between has their salary decreased by more than 1 scale (revised immediately).

Determining the Standard Bonus

- Regardless of their names such as bonuses, term-end allowances, and other bonuses which are paid as a consideration for labor, are the same kind of payment and, paid to a member not exceeding three times a year, are referred to as the “Standard Bonus.”

- A member’s Standard Bonus is the amount of bonuses, which is rounded down to the nearest 1,000 yen, received by the member within a single month. However, the maximum amount of a standard bonus for determining the Short-Term Benefits is set at 5,730,000 yen per year (April through March of the following year), and the maximum amount of a standard bonus (or the total amount of bonuses, if multiple bonuses are given within a single month) for determining the Pension Benefits is 1,500,000 yen per payment month.

- A member’s Standard Bonus is used to calculate the premiums (for Short-Term/ Pension Benefits, Nursing-Care) and Pension Benefits.

Note:

Other allowances such as entrance exam allowance, and cold district allowance that is supplied not exceeding three times a year are also included.

Special Exception for Monthly Standard Salary When Caring for Children under Age 3 (Special provisions for child raising)

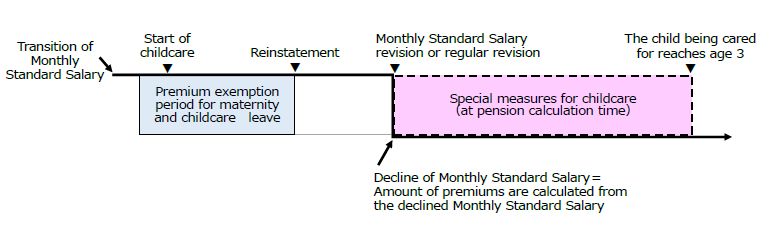

When caring for a child under age 3 (excluding the premium exemption period for maternity leave or childcare leave), if the Monthly Standard Salary decreases from that of the month previous to the child care starting month (normally, the month previous to the month when the child was born), there is a special exception to guarantee the amount of the Monthly Standard Salary of the previous month for calculating the pension benefits.

In order to qualify for these special provisions for child raising, an “application form for special exception for Monthly Standard Salary during childcare” must be submitted.

The special provisions are only effective used to calculate the pension benefits when the member reaches the pension age. Premiums or the The Short-Term Benefits are calculated based on the actual Monthly Standard Salary.

The member is eligible for the special provisions for child raising as the insured under the Welfare Pension insurance scheme across the organizations and companies implementing the scheme.

The Retirement Pension Benefits (under the new 3-stage pension scheme) are granted during the membership period only.

Transition of Monthly Standard Salary

Note:

From January 1, 2017, children under age 3 who meet the following conditions are also included.

1. Child in childcare test period before plenary adoption

2. Child in foster care intending adoption

3. Child approved as being appropriate for foster care intending adoption who, for reasons such as opposition from the original parents, is in foster care.

Japanese Site

Japanese Site Site Map

Site Map